are political contributions tax deductible irs

Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. According to the IRS.

Are Your Political Contributions Tax Deductible Taxact Blog

Political donations are considered charitable donations contributed by some people.

. Contributions or donations that benefit a political candidate party or cause are not tax deductible. Campaign committees for candidates for federal state or local office. Here are the main reasons why.

However there are differences from other philanthropic contributions which are tax deductible. Just know that you wont be getting a federal tax break. NW IR-6526 Washington DC 20224.

A political organization is subject to tax on its political organization taxable income. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years. What contributions are tax deductible.

It depends on what type of organization you have given to. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified. Required electronic filing by tax-exempt political organizations.

If youre self-employed however you can deduct the cost of any supplies or services you donate to a. Are Political Contributions Tax Deductible. You may deduct charitable contributions of money or property made to qualified organizations if you.

To help clarify any confusion specific. These nonprofits have been designated as charitable organizations by the IRS. Charitable contributions are tax deductible but unfortunately political campaigns.

If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. You can obtain these publications free of charge by calling 800-829-3676. Deductible contributions only apply to charitable organizations but political parties do not qualify for this designation.

Generally this tax is calculated by multiplying the political organization taxable. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you. Skip to main content.

As of 2020 four states have provisions for dealing. The Taxpayer First Act Pub. According to Intuit by TurboTax political contributions arent tax-deductible While charitable donations are generally tax-deductible any donations made to political.

Political Campaigns Are Not Registered Charities. The longer answer is. Only contributions to 501c3 organizations are tax deductible.

Funds given to charity are tax-deductible unlike political contributions. No political contributions are not tax-deductible for businesses either. You cant deduct contributions made to a political.

Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. Facebook marketplace dump trucks for sale near me x different symbols in probability x different symbols in probability.

Political contributions deductible status is a myth.

Are Political Donations Tax Deductible Credit Karma

Mining For Tax Gold Charitable Donations Aperio

Are Political Contributions Tax Deductible Smartasset

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Write Off Your Marketing Expenses And Save Money On Your Taxes

Tax Deductible Donations Can You Write Off Charitable Donations

Are Political Contributions Tax Deductible Anedot

45 Free Donation Receipt Templates 501c3 Non Profit Charity

Tax Exempt Organization Search

Are Political Contributions Tax Deductible Personal Capital

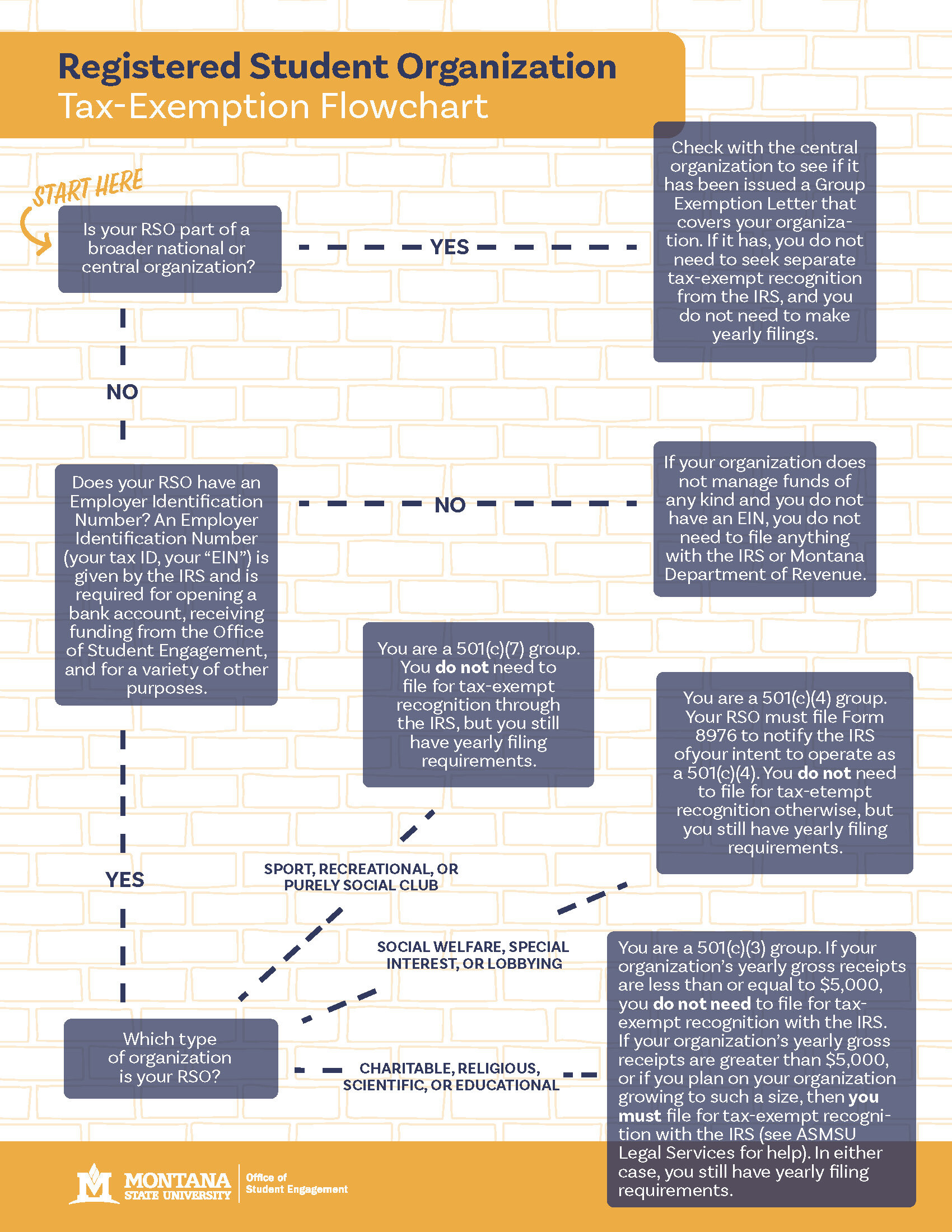

Student Organizations Non Profit Tax Faqs Msu Student Legal Services

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Are Political Contributions Tax Deductible Anedot

Irs Targeting Controversy Wikipedia

Why Political Contributions Are Not Tax Deductible