tennessee auto sales tax calculator davidson county

35000 Documentation fee. Standard fees and sales tax rates are listed below.

Are Your Property Taxes Too High Nashville Business Journal

10000 subtract Total vehicle sales price 25300.

. You can calculate Sales Tax manually using the formula or use the Davidson County Sales Tax Calculator or compare Sales Tax between different. Bill Hullander - Hamilton County Trustee. The Davidson County Sales Tax is 225.

Average Local State Sales Tax. Chattanooga TN 37402. Please Select a County.

Typically automobile and boat sales in Tennessee are subject to sales or use tax. 7 State Tax on the sale price minus the trade-in. Tennessee auto sales tax calculator davidson county.

10000 subtract Total vehicle sales price 25300. 15 to 275 Local Tax on the first 1600 of the purchase. 300 Add Trade-in allowance.

This is the total of state and county sales tax rates. US Sales Tax Rates TN Rates Sales Tax Calculator Sales Tax Table. Kingsport TN 37660 Phone.

Purchase Location ZIP Code -or- Specify Sales Tax Rate. Heres the formula from the Tennessee Car Tax Calculator. The sales tax calculator is for informational purposes only please see your motor vehicle clerk to confirm exact sales tax amount.

The few exceptions to this rule are when vehicles or boats are sold. 300 Add Trade-in allowance. The sales tax rate for Davidson County was updated for the 2020 tax year this is the current sales tax rate we are using in.

Between spouses siblings lineal. A county-wide sales tax rate of 225 is applicable to localities in Davidson County in addition to the 7 Tennessee sales tax. Maximum Possible Sales Tax.

Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions. Property Tax Inquiry. Vehicle Sales Tax Calculator.

225 West Center St. The minimum combined 2022 sales tax rate for Davidson County Tennessee is. WarranteeService Contract Purchase Price.

What is the sales tax rate in Davidson County. Call 865 215-2385 with further questions Sales Tax State Sales Tax is 7 of purchase price less total value of trade in. M-F 8am - 5pm.

210 Courthouse 625 Georgia Ave. The Davidson County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Davidson County local sales taxesThe local sales tax consists of a 225. Customer located in Davidson County.

35000 Documentation fee. Sales Tax Rate s c l sr. Sales tax in Davidson County Tennessee is currently 925.

Bought car in Florida and paid 6 Florida sales tax.

Automotive Tennessee Department Of Economic And Community Development

Car Tax By State Usa Manual Car Sales Tax Calculator

2002 02 Tennessee Tn License Plate Aub 534 Davidson County Ebay

Tennessee Sales Tax Rate Rates Calculator Avalara

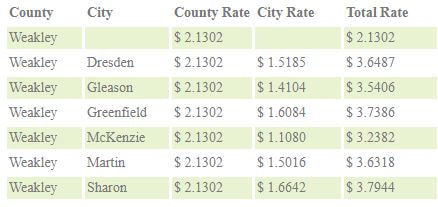

Weakley County Assessor Of Property Tax Rates

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

North Carolina Property Tax Calculator Smartasset

Davidson County Tn Sales Tax Rate Sales Taxes By County September 2022

Davidson County Clerk Nashville Gov

Tennessee County Tax Statistics Ctas

Counties With Improved Housing Availability Pre Covid 24 Affordable Housing Resources Rocket Mortgage

Tennessee County Clerk Registration Renewals

Davidson County Tn Real Estate Davidson County Tn Homes For Sale Zillow

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

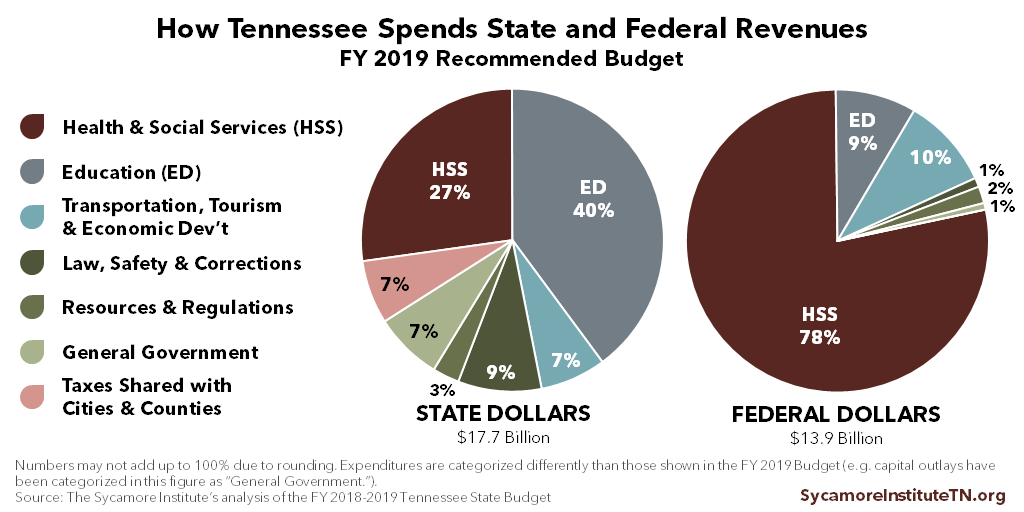

Tennessee Budget Primer The Sycamore Institute

Tennessee Sales Tax Small Business Guide Truic

How Much Sales Tax For A Car In Tennessee

Davidson County Clerk Nashville Gov

Vivian Wilhoite Davidsonco Assessor Of Property Nshpropassessor Twitter